Cost, Insurance, and Freight (CIF) Definition, and Rules of Shipping Agreement

May 20, 2024 By Susan Kelly

Defining the responsibilities while shipping a product overseas is an essential part of trading internationally. The CIF (Cost, Insurance, and Freight) is the essential agreement that defines the rules and regulations of overseas trade, which is also considered a mutual agreement between the buyer and seller. To give you a better overview of CIF, we have written this comprehensive guide to discuss what is Cost, Insurance, and Freight (CIF) and what are the rules of the CIF shipping agreement.

What is CIF (Cost, Insurance, and Freight)?

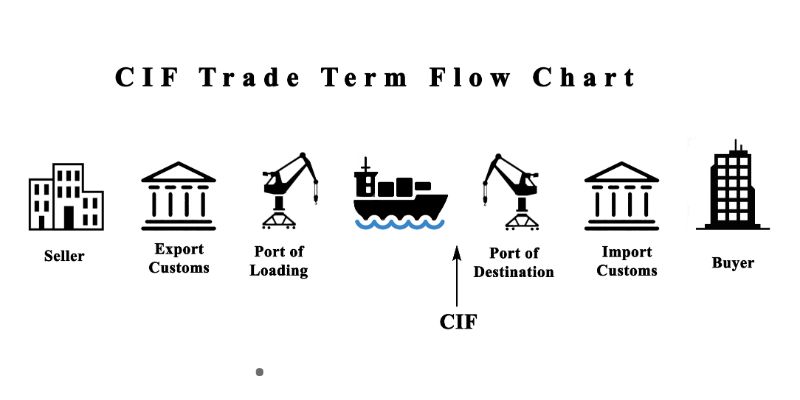

Cost, Insurance, and Freight (CIF) is known as the shipping agreement that takes place between the buyer and a seller for the commodities that are carried by water, ocean, or sea. The CIF shipping agreement states the charges paid by the seller in order to cover any costs, freight, and insurance for the order shipped to the buyer while it is in the transition.

Cost, Insurance, and Freight are among the 11 Incoterms rules that are defined by the International Chamber of Commerce. The goods that need to be shipped are exported to the port mentioned in the sales agreement, which is under the buyers name.

After the goods are transferred into the container or shipping vessel, any risks of loss or damage are transferred from the buyers name to the sellers name. However, its still the sellers responsibility to ensure the cargo and pay for the freight.

What Are the CIF Rules for Buyers and Sellers?

The terms defined in the CIF (Cost, Insurance, and Freight) agreement define when the responsibilities of the buyer start and when the responsibilities of the seller end. The CIF agreement only applies to the shipping of freight that is sent overseas or via the water channels.

According to the CIF agreement, the main responsibility of the seller is to pay the freight and cost of sending goods to the port where the buyer can receive them. CIF is more common for exporters who have direct access to a ship. But at the same time, there are some responsibilities on the buyers end too. Let us show you how the whole process works.

Responsibilities of the Seller in CIF

- Buying the export license for shipping the freight.

- Stating the inspection of goods being shipped overseas.

- The seller has to pay any charges or shipping fees, including the loading costs, to the sellers port.

- The seller has to pay any costs of packaging the goods for exporting them as cargo.

- The seller has to pay any customs clearance fees, taxes, or duty charges for exporting the goods.

- The seller has to pay the costs of shipping to send the goods from their port to the sellers destination port.

- The seller has to pay the insurance costs of the shipment until the shipment reaches the buyers port.

- The seller is responsible for covering any costs in case of damage or destruction of the goods while shipping.

- The seller is bound to deliver the goods according to the time frame mentioned and agreed upon in the CIF agreement.

- The seller has to provide proof of delivery and loading.

Responsibilities of the Buyer in CIF

Once the shipment has arrived at the buyers port of destination, the major responsibilities are then transferred to the buyers end. The costs related to the import and delivery of shipment and then transferred to the buyer along with the following liabilities.

- Unloading the shipment and the product at the destination port.

- Transferring the goods within the boundaries of the terminal and then taking them to the delivery site.

- Buyer has to pay any custom tax, duty, or charges related to the imported goods.

- Any costs of unloading, delivering, and transporting the goods to the final destination are covered by the buyer.

What is the Risk of Transfer in CIF?

It is vital to understand that shipping goods internationally come with a substantial amount of risk and transfer of costs at various points. This exchange of risk is agreed upon between the buyer and the seller, which depends on the terms of the agreement.

- According to the CIF, the risk of transfer is considered a different fact as compared to the costs of transfer.

- The timeline and other terms of the agreement state when the risk factor is transferred from the buyer to the seller.

- It is the sellers responsibility to pay for the shipping, insurance, and freight costs until the buyer receives the shipment at their port.

The cost transfer takes place when the goods arrive at the buyers destination port. However, the risk of transferring shifts from buyer to seller right after the goods are loaded into the transferring vessel. If the goods are damaged during the shipping process, the buyer can claim the amount from the sellers insurance company since the seller bought the insurance for the goods.

Is there a Special Consideration in the CIF Agreement?

Even though the CIF agreement may seem more in favor of the buyer as compared to the seller, there are some special considerations too. Since the buyer takes the risk only when the goods have been loaded in the shipment, there are certain situations that may not be suitable for CIF.

For example, when the goods are transferred in the containers, they may sit at the sellers port for days. In such a condition, the buyer would be at risk if the goods are not insured and they sit in the container for days. Hence, the CIF agreement may not be appropriate for the containerized cargo.

Conclusion

Cost, Insurance, and Freight (CIF) agreement gives more advantages to the buyer as compared to the seller. The risk and cost factors are shared by both parties, yet the buyer could also face damages in some special cases. Hopefully, this article has given you a brief overview of what is Cost, Insurance, and Freight (CIF) and what are its rules.

-

Know-how May 16, 2024

Know-how May 16, 2024Breaking Down Health Insurance: Terms, Conditions, and Policies

An essential guide to understanding health insurance, including key terms, types of policies, and how government policies like the ACA impact coverage.

-

Investment May 20, 2024

Investment May 20, 2024What is Options Trading and How to Master it?

Learn about options trading in this beginner guide. Understand the strategies, risks, and ideas for successful investing

-

Investment Dec 23, 2023

Investment Dec 23, 202310 Common Repairs You Need to Handle in Your Rental

Discover the repairs tenants should handle themselves. Learn when it's your duty, not your landlord's, to fix common issues in your rented space.

-

Taxes Dec 29, 2023

Taxes Dec 29, 2023Principles of Ability-to-Pay Taxation: An Overview with Examples

Learn what Ability-to-Pay Taxation is and how it works. Get the information you need, along with its history and benefits.